Once considered more unconventional, equipment leasing has now become mainstream. In addition to being a cost-effective opportunity, the practice is helping to level a crowded playing field within the personalization industry by giving new and small business owners greater access to funding. And as persistent inflation and high interest rates continue to apply financial pressure on business owners, equipment leasing is likely to continue to rise in popularity.

Equipment Leasing Rises Amid Economic Strains

More Personalization Companies Are Pursuing Leasing Options.

By: Stefanie Galeano-Zalutko

(Originally printed in the July/August 2024 issue of Insights.)

Once considered more unconventional, equipment leasing has now become mainstream. In addition to being a cost-effective opportunity, the practice is helping to level a crowded playing field within the personalization industry by giving new and small business owners greater access to funding. And as persistent inflation and high interest rates continue to apply financial pressure on business owners, equipment leasing is likely to continue to rise in popularity.

The personalization industry is expanding quickly in size and scope, exposing some growing pains in the process. With the cost of essential operating equipment on the rise, the Equipment Leasing and Finance Association (ELFA) says nearly 80% of U.S. companies rely on some kind of funding—whether it be loans, leases, or lines of credit—to make necessary business investments. The equipment-leasing and finance industry continues to grow as a result, with Allied Market Research projecting it to climb from $1.2 trillion in 2022 to $3.1 trillion in 2032.

While traditional banking institutions accounted for 53% of total funding a few short years ago, industry experts note the financial landscape is evolving rapidly in response to market shifts and customer needs.

Banks, which naturally lean fiscally conservative and risk-averse, arrive at credit and capital-lending decisions differently—and typically more slowly—than specialized equipment-financing companies like Geneva Capital and Ascentium Capital.

Small business owners, including those in the personalization industry, may be the entrepreneurial backbone of America—accounting for 62.7% of net jobs created since 1995 and employing 46.4% of private sector employees. Yet they often face roadblocks when trying to secure funding through traditional channels.

“With more start-ups emerging, financing has become harder for businesses under two years old, as they typically lack [solid] credit history,” says Susan Cox, founder and CEO of LogoJET. “In addition, the pandemic has led to tighter credit markets overall, making it more challenging for businesses to secure financing.”

New and veteran businesses alike are experiencing diverse financial challenges under mounting pressure, says Geneva Capital Senior Account Manager Carey Kroll.

“It’s very common for me to hear that even well-established companies cannot get a loan from a bank because they just aren’t familiar with the [business model and] equipment. They’ll give $75,000 for a vehicle loan because they know and understand vehicles but won’t approve funding for an asset that’s going to grow a business and make them money,” Kroll says. “It just blows my mind.”

Kroll says business owners with bank connections may be more successful in obtaining a loan, but it’s difficult without a personal relationship. “Without a contact, even established businesses are having a very tough time,” she says.

Stubborn inflation and high interest rates are significantly impacting business decisions as well, prompting owners to explore different funding strategies to improve daily operations, enhance productivity, and reinvest in the business.

What is certain, Cox emphasizes, is that economic volatility is having a ripple effect.

“With inflation driving up costs, maintaining cash flow is crucial,” she says. “Businesses may delay purchasing decisions [altogether] or seek alternative financing options to mitigate the impact of higher costs.”

As such, many providers are “getting more creative” by offering deferred financing up to six months, thus giving customers opportunities to secure leased equipment immediately and create some positive cash flow before the first loan payment, says Craig Colling, senior vice president and vendor channel leader at Ascentium Capital.

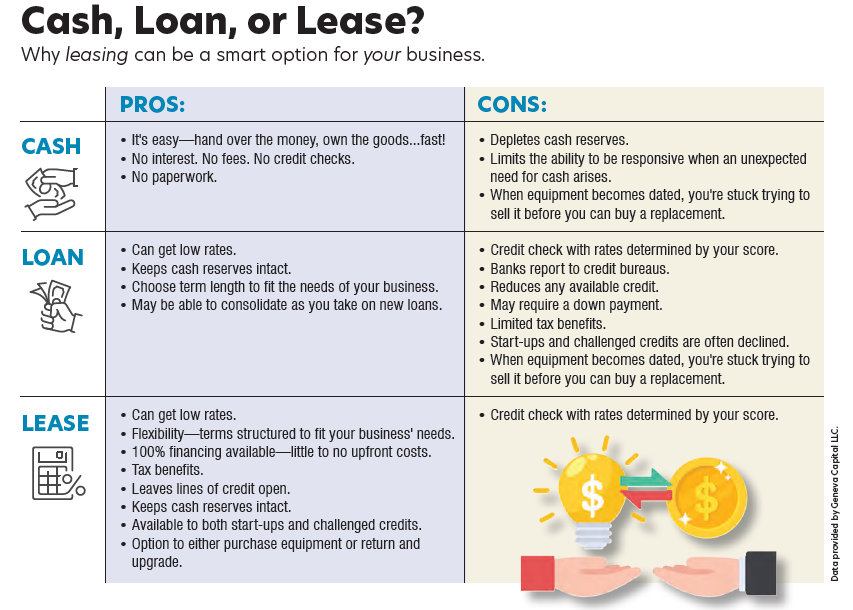

In response to the current economic mood, personalization industry professionals say more company decision-makers are pursuing equipment leasing instead of paying cash or financing to own.

“High credit rates, for example, make conventional financing more expensive, leading some businesses to prefer leasing to avoid large capital expenditures,” Cox says.

Today, research from ELFA and other industry organizations shows eight in 10 companies, especially start-ups and small businesses, now prefer to lease some or all of their equipment.

While equipment leasing was less conventional in years past, the practice is commonplace today. This trend is poised to capture even greater market share within the equipment leasing and finance industry, as technological advancements expand in scope, capabilities, and cost.

Laser-Sharp Funding

Every business, big or small, should consider the benefits of proper funding, especially with inflation raising hard costs of goods in various industries, ranging from 5% to 25% over the past several years, according to Colling.

“A finance or lease program that assists a customer with little to no down payment, deferred payment options, and fixed payments may be crucial for equipment acquisitions and positive cash flow from day one,” Colling says.

Traditionally, established large and medium-sized businesses have been more likely to possess the credit history and cash flow necessary to pay for equipment outright, absorb the initial costs, and benefit from long-term savings. Some are taking the opportunity to secure loans for equipment leasing and free up capital for other purposes.

“We are seeing more medium-sized businesses take advantage of financing, especially those who are new at printing in-house, so that they can leverage monthly budgets for new technology,” Cox says.

Many new or small business owners rely on leasing to expand their access to essential equipment without enduring substantial capital investment. In addition to cost management, equipment leasing provides fast financing with flexible contract terms.

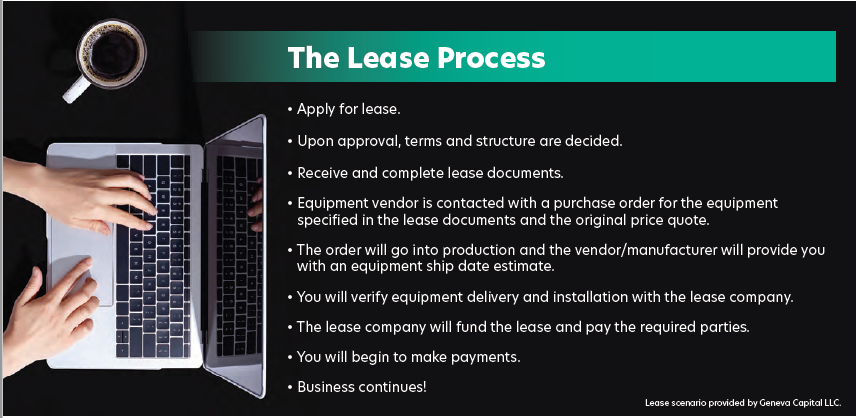

While applying for any kind of funding can be stressful, financial professionals reassure business owners the application process is rather quick and painless. Required documentation, such as tax returns and financial statements, varies on a case-by-case basis, but most applications are completed in minutes and approved within hours.

At Ascentium Capital, for example, a credit check and application are often all that is required to secure $250,000 in funding, with various financing options available to cover up to $2 million in new and used equipment or technology. Moreover, full payments may be delayed or stretched out for up to 84 months.

“Leasing allows businesses to acquire equipment without a large upfront investment. Instead, they can spread the cost over time through manageable lease payments,” says Amy Dallman, marketing communications specialist at Epilog Laser, adding that the cost is historically lower than traditional-loan payments. “This helps businesses maintain better cash flow and budget effectively.”

While Geneva Capital and Ascentium Capital both offer financial products and services for a variety of business models—from mom-and-pop shops to large, well-known companies—those drawn to leasing tend to be entrepreneurial and competitive in nature.

“We serve a pretty even split, but startups have performed quite well for us,” Kroll says. “We don’t shy away from them like other [financial institutions] do.”

Dallman says third-party leasing companies like Geneva Capital specialize in providing attractive financing solutions for many Epilog Laser customers, with competitive terms and customizable agreements for each customer. Options include fair market value, $1 buyout, and 10% purchase option leases, along with flexible plans such as seasonal, reduced, step-up, and delayed payment. Specialized start-up or learning-curve leases are available as well.

Capitalizing on Change

In the personalization industry, technology is crucial for day-to-day operations. Through leasing, Dallman says owners can access the latest equipment without the burden of obsolescence.

“Business owners must review their current equipment condition and if their current equipment assets are meeting production needs,” Colling says. “If production needs are not being met or stifling growth, for example, then regardless of increased equipment costs and higher costs of capital, a business owner may have no choice but to replace or upgrade equipment.”

Dallman says leasing agreements often include provisions for upgrading to newer models, ensuring owners are equipped to remain competitive with the latest cutting-edge technology.

“It just depends on the type of laser the customer needs, how much money they have to work with, and how much space they have,” she says.

At Geneva Capital, equipment can be purchased or returned to the lessor at the end of the lease, allowing businesses to upgrade without having to manage disposal and other burdens. Cox reminds businesses to be diligent and fully evaluate any equipment acquisition, regardless of the funding structure, so they understand the upfront costs, along with recurring costs of operation, while comparing the cost outlays to revenue associated with equipment use.

Lease tax benefits are attractive as well, according to Kroll and Dallman. They say the IRS does not consider an operating lease to be a capital expenditure or purchase. Instead it is a tax-deductible overhead expense. Under section 179, 100% of the equipment cost is deductible from income during the year it was acquired. Also, because lease payments are treated as expenses on a company’s income statement, equipment does not depreciate, per usual, over five to seven years.

“[Together], this can result in significant tax savings for businesses in the personalization industry,” Dallman adds.

Plus, because an operating lease is not considered a long-term debt or liability, it does not appear as “bad debt” on a balance sheet—keeping credit lines open for the business and appeasing traditional lenders, if necessary, in the future.

Looking Ahead

Given current economic conditions, Cox understands why businesses may be tempted to delay any purchasing decisions or seek alternative financing options to offset rising costs. However, she says those who wait for interest rates to decrease may miss opportunities to stay competitive.

“Competitors with strong cash flow who invest in necessary equipment [and upgrades] now can gain a market advantage, leaving those who delay at a potential disadvantage,” she says.